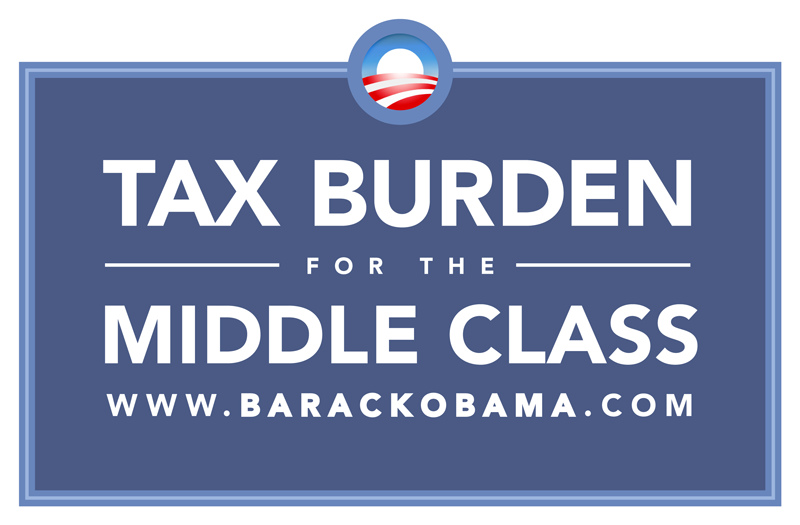

New Obamacare Tax To Hit 6 Million Americans

Obamacare: More Tax…Less Filling

When the Democrats enacted Obamacare they did so with the assumption that everyone would peacefully come in line and purchase health insurance. Wednesday congressional budget analysts predicted that nearly 12 million Americans, a majority of them in the middle class, will be hit with a tax penalty for not carrying medical coverage once Obamacare is fully in place and 50 percent of them will pay the penalty rather than purchase insurance.

The nonpartisan Congressional Budget Office (CBO) released numbers this week that were significantly higher than the original estimates the projected in 2010.

In the earlier estimate the CBO predicted that 4 million people would be affected by the tax penalties; the new estimates represent a 50 percent increase over what the country was told after the law was enacted.

While 6 million might not seem like a huge number in a nation where more than 150 million people are currently covered by employer plans, it also means that the president’s pledge not to raise taxes on individuals making less than $200,000 a year and couples making less than $250,000 has gone out the window.

Further analysis by the CBO found that nearly 80 percent of those who’ll face the penalty would be in the income levels of $55,850 or less for an individual and $115,250 or less for a family of four; dead smack in the middle-class. The penalties the uninsured would face would be about $1,200 per person in 2016.

“The bad news and broken promises from Obamacare just keep piling up,” said Rep. Dave Camp, R-Mich., chairman of the House Ways and Means Committee, who wants to repeal the law.

The budget office said most of the increase in its estimate is due to changes in underlying projections about the economy, incorporating the effects of new federal legislation, as well as higher unemployment and lower wages.

Starting in 2014, the new health care law requires virtually every legal resident of the U.S. to carry health insurance or face a tax penalty. The Supreme Court upheld Obamacare law as constitutional in a 5-4 decision this summer, finding that the insurance mandate and the tax penalty enforcing it fall within the power of Congress to impose taxes. The Obamacare penalty will be collected by the IRS, just like taxes.

The CBO said the Obamacare penalty will raise $6.9 billion in new federal revenue when fully in effect in 2016.

Obamacare To Do Little To Stem Soaring Health Care Costs

Rather than address the problem of uninsured persons showing up in hospital emergency rooms it is likely all that Obamacare will do is generate income for a government which fritters away tax dollars like so much confetti. Younger, middle-class individuals are likely to choose to pay the penalty rather than pay thousands more to purchase health insurance. Simply put Obamacare becomes little more than a tax on younger middle-class families and individuals.

The Supreme Court ruling on Obamacare will allow individual states to opt out of the major Medicaid expansion under the law that would cover lower-income persons; the Obama administration’s response is to exempt low-income people affected by state decisions from having to comply with the insurance mandate. The exemption of low-income persons and states bowing out of the Medicaid expansion means little will be accomplished to provide health insurance for impoverished families.

Obamacare assumed that by bringing millions of healthy younger people into health insurance pools that it would provide a means to cover the cost of pre-existing conditions and health care for the poor. Since many younger middle-class and lower-class persons are now likely to opt out the chance that Obamacare will have any positive effect on soaring health care costs is now obliterated.

The net effect is that Obamacare will result in far higher premiums for the average health insurance consumer and a nice new income stream for our bloated government.

—————————————————————

Subscribe to Mr. Kaplan’s articles at Examiner.com

Read Mr. Kaplan’s blog at Conservatively Speaking

Email Mr. Kaplan at ken@conservativelyspeaking.us

Join Mr. Kaplan on Facebook at ConservativelySpeaking

Follow Mr. Kaplan’s tweets at ConsSpeaking